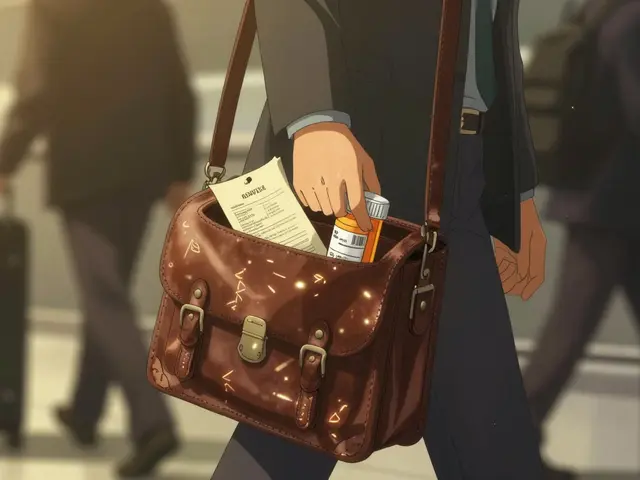

When you’re paying for prescriptions, every dollar counts. If you’re still paying full price for a medication you think should be cheaper, you’re not alone. Many people don’t realize that generics and authorized generics can cut their costs by 80% or more-but only if they know how to ask for them. The key isn’t just knowing they exist. It’s knowing how to talk to your pharmacist and insurance plan about the differences between them.

What’s the Difference Between Generic and Authorized Generic Drugs?

A generic drug is a copy of a brand-name medication that becomes available after the patent expires. It must contain the same active ingredient, work the same way in your body, and meet the same safety standards as the original. The FDA requires generics to be bioequivalent-meaning they deliver the same amount of medicine into your bloodstream within a very tight range (80-125% of the brand). Most generics are made by different companies, often overseas, and sold under a different name. An authorized generic is different. It’s made by the same company that produces the brand-name drug, often in the same factory, using the exact same formula and ingredients. But instead of selling it under the brand name, the company puts it on the market under a generic label-sometimes even the same packaging, just without the brand logo. Think of it like a store-brand version of a product made by the same company that makes the name-brand version. Why does this matter? Because even though they’re chemically identical, insurance plans and pharmacies treat them differently. That affects what you pay out of pocket.How Much Can You Really Save?

The numbers speak for themselves. In 2022, generic and biosimilar drugs saved the U.S. healthcare system over $408 billion. Over the past decade, that total reached $2.9 trillion. For individual patients, the savings are just as dramatic. After a brand-name drug loses its patent, prices usually drop by more than 75% within a year. Some drugs-like the HIV medication Truvada-saw prices fall from $50 per pill to just $3. That’s a 94% drop. But here’s the catch: list prices aren’t always what you pay. Your out-of-pocket cost depends on your insurance plan’s formulary, pharmacy benefit manager (PBM), and whether the generic is traditional or authorized. According to the Association for Accessible Medicines (AAM), 93% of generic prescriptions cost less than $20 in copays. For brand-name drugs? Only 59% do. The average generic copay is $6.16. The average brand-name copay? $56.12. Still, some patients pay more than expected-even for generics. Why? Because PBMs negotiate rebates with drugmakers, and those rebates don’t always translate into lower prices for you. Sometimes, an authorized generic has a lower list price than a traditional generic, but your plan puts it on a higher tier, so your copay stays the same.What to Say to Your Pharmacist (and When to Say It)

Most pharmacists know generics are cheaper. But many don’t know the difference between authorized and traditional generics-or how insurance handles them. That’s why you need to ask the right questions. Here’s exactly what to say:- “Is there a generic version of this medication?” This is your starting point. If the answer is yes, move on.

- “Is this an authorized generic?” Ask this even if they say yes to the first question. Some pharmacies don’t automatically offer AGs unless prompted.

- “How does my insurance treat authorized generics versus traditional generics?” This is the most important question. Some plans treat AGs like brand-name drugs. Others put them on the lowest tier. You won’t know unless you ask.

- “Can I switch between generic types to save money?” Sometimes, the same drug is available as both a traditional generic and an authorized generic. One might have a lower cash price or better copay.

Why Authorized Generics Can Be Trickier Than They Look

Authorized generics often have lower list prices than traditional generics. For example, authorized versions of drugs like Epclusa and Harvoni were priced 50-67% lower than the brand. But here’s the twist: because they’re made by the brand company, they sometimes don’t go through the same rebate negotiations as traditional generics. That means:- Your plan might not get a rebate on an authorized generic, so it doesn’t lower your copay.

- Your plan might put the authorized generic on a higher tier because it’s “still connected” to the brand.

- Some PBMs don’t even track authorized generics separately-so your pharmacist might not know the difference.

How to Compare Prices Yourself

Insurance plans vary wildly. What works for one person won’t work for another. That’s why you need to check prices yourself. Use tools like GoodRx or SingleCare to compare cash prices for:- The brand-name drug

- The traditional generic

- The authorized generic

What If Your Plan Won’t Cover It?

If your insurance denies coverage or puts the generic on a high tier, you have options:- Ask your doctor for a prior authorization. Sometimes, just asking gets your plan to reconsider.

- Request a formulary exception. Most plans have a process to appeal coverage decisions.

- Use a patient assistance program. Many drugmakers offer discounts or free medication for low-income patients.

- Try a different pharmacy. Prices vary by location-even within the same city.

What About Biosimilars?

If you’re taking a biologic drug (like Humira, Enbrel, or insulin), you’re likely dealing with biosimilars instead of generics. These are highly similar-but not identical-copies of complex biologic medications. They’re newer, and prices are still coming down. In 2023, biosimilars saved over $7 billion, with average prices 50% lower than the original. Ask your doctor if a biosimilar is an option for you.Why This Matters Right Now

The FDA’s 2023 Drug Competition Action Plan is targeting hard-to-copy drugs like inhalers, skin creams, and injectables where generic competition has been slow. More approvals are coming. That means more savings ahead. But if you don’t ask, you won’t get them. Most patients don’t realize they have choices. They just accept what’s on the receipt. The truth? You have more power than you think. You can ask for generics. You can ask which kind. You can compare prices. You can switch pharmacies. You can appeal your plan. It takes a few minutes. But it could save you hundreds-or thousands-over the year.Are authorized generics as safe as traditional generics?

Yes. Both authorized generics and traditional generics are FDA-approved and must meet the same strict standards for safety, strength, quality, and performance. Authorized generics are made by the brand company in the same facility using the same formula. They’re not inferior-they’re just marketed under a different label.

Why is my copay the same for a brand and an authorized generic?

Your insurance plan may treat authorized generics the same as brand-name drugs because they’re made by the same company. Even if the list price is lower, your plan’s formulary might not reflect that. Always ask: “How does my plan treat this specific version?”

Can I switch from a brand to a generic without my doctor’s approval?

In most cases, yes. Pharmacists can substitute a generic for a brand-name drug unless the prescription says “dispense as written” or “no substitutions.” But if you want to switch between a traditional generic and an authorized generic, you may need to ask your pharmacist or doctor for clarification.

Do generics work as well as brand-name drugs?

Yes. The FDA requires generics to be bioequivalent, meaning they deliver the same amount of active ingredient into your bloodstream at the same rate as the brand. Studies consistently show no difference in effectiveness or side effects between generics and brand-name drugs.

What if my pharmacy doesn’t stock authorized generics?

Ask them to order it. Many pharmacies can get authorized generics within 1-2 days. If they say no, try another pharmacy. Prices and availability vary widely between locations. You can also check GoodRx to find nearby pharmacies that carry it.

Why don’t more people know about authorized generics?

Because drugmakers and insurers don’t always make it easy. Some brand companies used authorized generics to delay competition from traditional generics. While this practice is declining, many pharmacists still aren’t trained to explain the difference. Patients have to ask-and that’s how you take control.